Winning Financial Solutions Your Company Needs

Flexible financing options that let you manage your business needs on your own are key to every entrepreneur. We’ll help you structure finance payments that match your unique needs with our fast, flexible financing custom programs.

- Equipment Financing

- Equipment Leasing

- Working Capital

- Receivable Factoring

- Master Leases

- Deferred Payment Options

- Step-down Payments

Easy finance Options

- Simple application-only up to $150,000

- 100% financing

- Credit decisions as quick as 2 hours

- Flexible options including $1 Buyouts, Purchase Upon Termination and Fair Market Value

- Quick one-page document for small ticket transactions

- Convenient payment options including ACH, online and by credit card

Citi Capital Group offers most competitive rates and can meet your immediate financial needs so you can focus on what matters most:

Taking your Business to the Next Level.

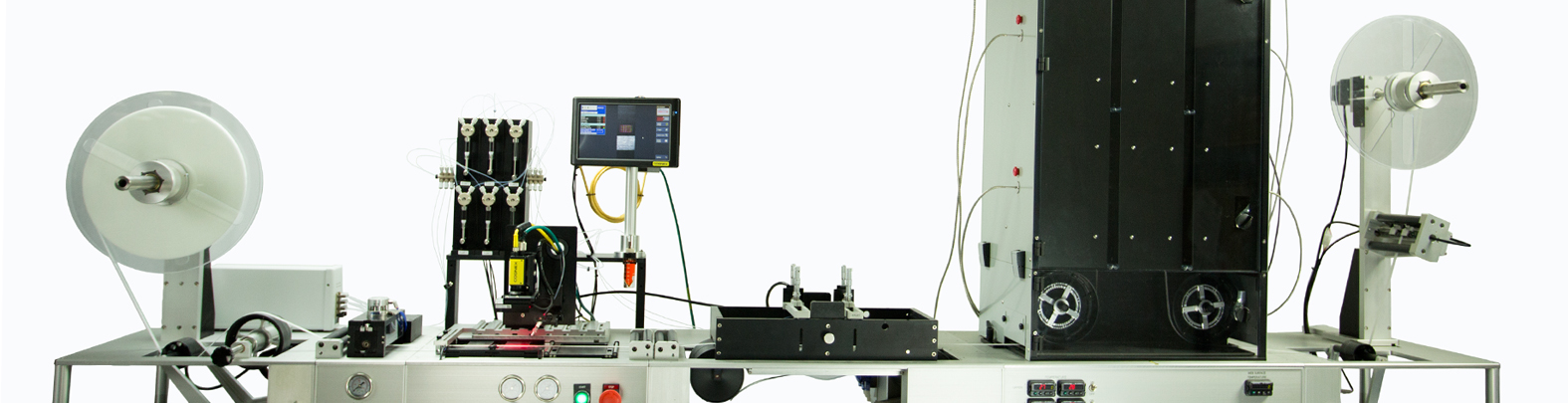

EQUIPMENT LOANS

Equipment is one of the most important assets for any business. Without the proper working tools, business can grind to a halt. An equipment loan can be used to purchase new or used equipment. Like most business expenses, equipment typically pays for itself over the course of its lifetime. Fully functioning equipment leads to increased productivity and a better production process. It’s next to impossible to maintain a business without the right tools.

With pros there are always cons, and buying equipment is no exception. Obtaining the equipment needed for your daily business operations can vary drastically in cost. While some materials may be easily purchased, other high-cost items can often be difficult for a small business to afford. While it may be difficult to acquire the funds needed to cover equipment costs, there are very few workaround’s for many industries

Working Capital Loans

A working capital loan can be utilized in a multitude of ways. These types of loans are a form of “all- purpose borrowing,” meaning you can apply these loans to nearly any aspects of your business to further your growth wherever it is needed. Common uses for these loans include, but are not limited to:

- CASH FLOW LOANS

A working capital loan can be used to secure cash flow for your business. If your business is experiencing a declining working capital ratio over a long-term period, this may be a good choice for your business. However, it may be hard to obtain an unsecured business loan through a bank if you don’t have good personal credit. These loans are very flexible and we can help.

- DEBT CONSOLIDATION

Working capital loans can be used as a debt consolidation loan for a business. Between purchasing orders and keeping up payroll, a business may end up buried in a pile of debt and interest rates.

- MARKETING EXPANSION

As a business grows, so should the marketing efforts. Although marketing is essential to the growth and well-being of a business, marketing expenses can be difficult to evaluate and cause quite a dent in a business’s income. A working capital loan can be utilized to purchase marketing expansion without worrying about breaking the bank for a necessary service.

- INVENTORY LOANS

If you manage products and maintain a large inventory, having cash at hand is a must. Meeting the demand of your customers is vital to your profitability and business reputation. Running a business can put you in a position where you must make a purchase that is only offered for a limited time or has a short shelf life, requiring you to come up with an immediate capital solution. Aside from this, seasonal shifts in sales and supply volumes can take a toll on the working capital of a business. This can create a greater demand for more inventory than usual, which is why an inventory loan would be valuable to your business.

- SEASONAL INVENTORY

Many businesses experience cycles in their supply and demand, often referred to as the “busy” and “slow” seasons. To avoid running out of inventory during peak season, inventory loans allow businesses to attain the supplies they need to keep up with fluctuating periods of demand in their industry. Inventory loans can help a business take advantage of busy seasons so they can survive through the slow seasons.

- SHORT TERM INVENTORY

Some businesses in certain industries need to acquire a product that has a short shelf life. These products will need to be acquired, shipped and sold within a short time frame. Inventory loans are designed to cover these situations so businesses don’t miss out on short-term opportunities. They provide the necessary flexibility to keep up with competitors and maintain an edge on emerging trends.

- EXPANSION LOANS

Financial growth and internal business expansion go hand in hand. Business growth requires capital, which is not always immediately available. The old maxim rings true in this situation more than ever; if you aren’t growing, you’re dying. For any business to succeed it needs to constantly look forward into ways they can expand their products and services.